Donation

Home » Donation

Donate

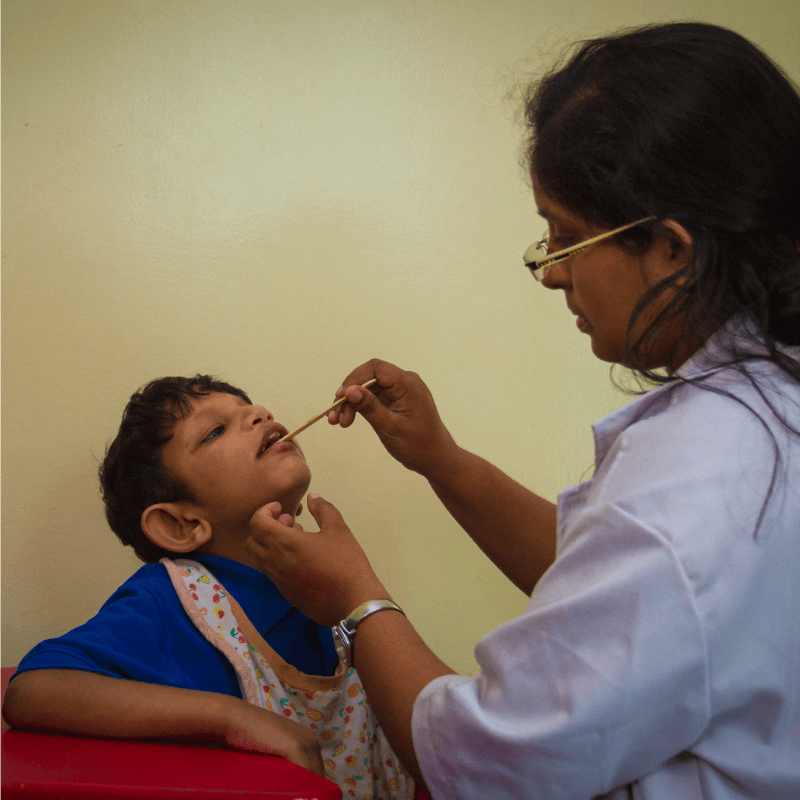

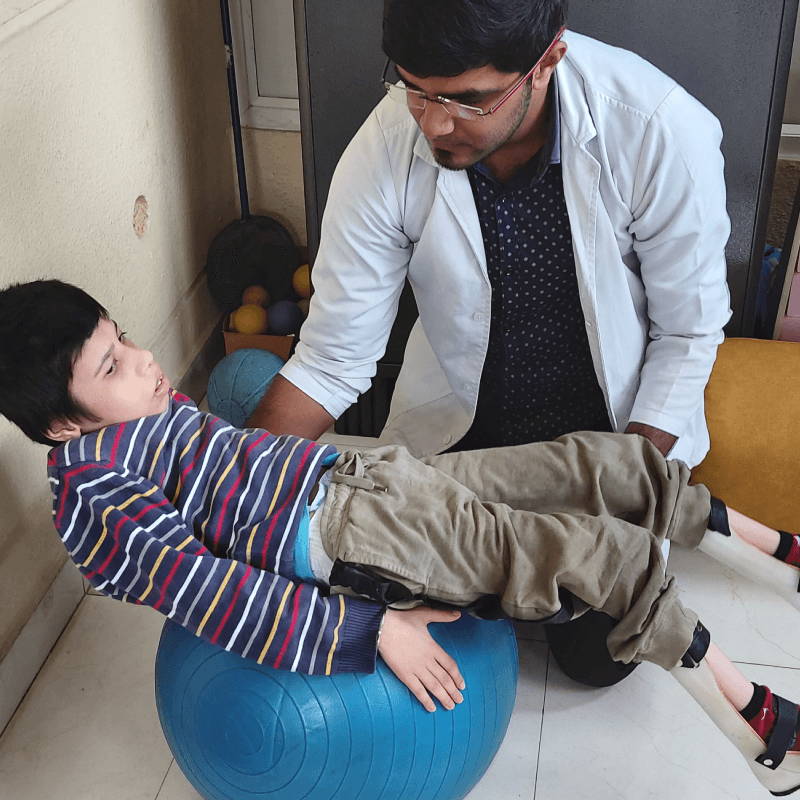

Your contribution to Akshadhaa Foundation can enable us to make the services reach to the children and young adults of families with poor financial background. Your support can help them to avail required therapy, school education and vocational skill training which can enable them to gain meaningful livelihood in the future. Your help will impact the lives of not only the people with Intellectual and Developmental disabilities but their families as well.

You are welcome to offer your support in the form of financial and non-financial as well.

Donations to Akshadhaa Foundation are eligible for 50% tax exemption under section 80G of the Income Tax Act, India. Your donations are allocated where the need is greatest for providing services and ensuring rights of persons with disability.

All Indian passport holders and Indian tax-payers can make a donation to AKSHADHAA FOUNDATION by drawing a cheque in favour of “Akshadhaa Foundation and sending it to the address

Make a donation to Akshadhaa Foundation by drawing a cheque in favour of “Akshadhaa Foundation” and sending it to the address: Foundation Vocational Training and NIOS Center

# 2C – 720, 2nd Cross, HRBR Layout, Block 1 , Banaswadi, Bangalore – 560 043.

Please ensure that you attach a cover note to the cheque stating your full name, email, phone, full postal address, pan number to help us issue and send across a receipt to you.

Or If you are in Bangalore we will come to your residence to pick up your donation cheque

as and when required. Request you please share your address through email or call so our

staff can come and collect your donation cheque.

Avail tax exemption under Section 80G

Bank Name: HDFC

Account Name: Akshadhaa Foundation

Account Number: 50100207331067

IFSC CODE: HDFC0002815

BANK CODE: 002815

Avail tax exemption under Section 80G

Akshadhaa Foundation is authorized to receive foreign contribution under Foreign Contribution Regulation Act. Our FCRA Registration no. is 094421792

Please reach us to info@akshadhaafoundation.org for details to transfer to our SBI Delhi Branch Account as we need some information from our well wishers before we provide bank details.

Our Credentials

- Registered under Indian Trust Act: Registration no. 2035 Registration date: 16/10/2012

- Registered under Section 12 A/10 (23C) of Income Tax Act 1961

- Registered under 80G of IT Act

- Permission under FCRA for receiving foreign donations with Registration number FCRA- 094421792

- Registered non profit organization under Indian Institute of Corporate Affairs (IICA) in 2016 and IA Hub code is A000323

- Registered with NGO Darpan portal NITI Aayog ID : UID no. KA/2018/0211715

- Our PAN : AADTA7639L

- All Indian donors are eligible to receive 50% tax exemption under Section 80G of the Income Tax Rules

- Laptops

- Grocery kits for cooking and baking classes

- Garden tools, pots, soil and manure for horticulture training unit

- Others : ——–

You can write to info@akshadhaafoundation.org for pick up

In India, over 21 million people are suffering from one or the other kind of disability. This is equivalent to 2.1% of the population.

By associating with Akshadhaa Foundation on the CSR front, our corporate partners support our projects and ensure their continuous operation, fulfilling their social responsibility. These partnerships largely aid in the implementation of Akshadhaa’s initiatives, their sustainability, upscaling, and geographical expansion. Akshadhaa Foundation, with the help of its CSR allies, is positive of accomplishing its goals and help in building a society where persons with disabilities enjoy equal rights.

Akshadhaa Foundation invite you to come join us and feel the happiness.

Contact Akshadhaa for more details:

info@akshadhaafoundation.org

+91 96322 20375

Avail tax exemption under Section 80G

Online Payment

Scan and donate with any UPI App